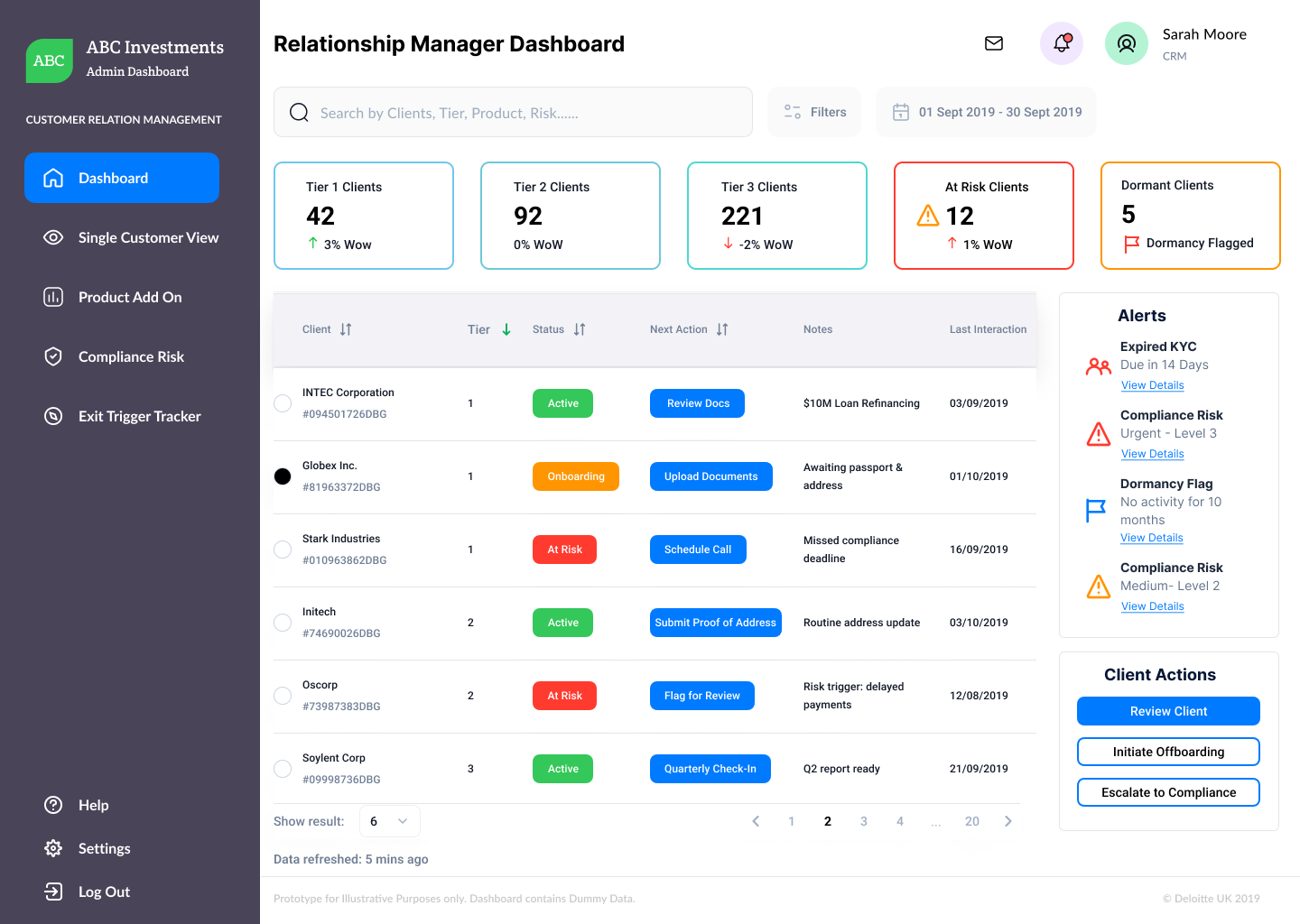

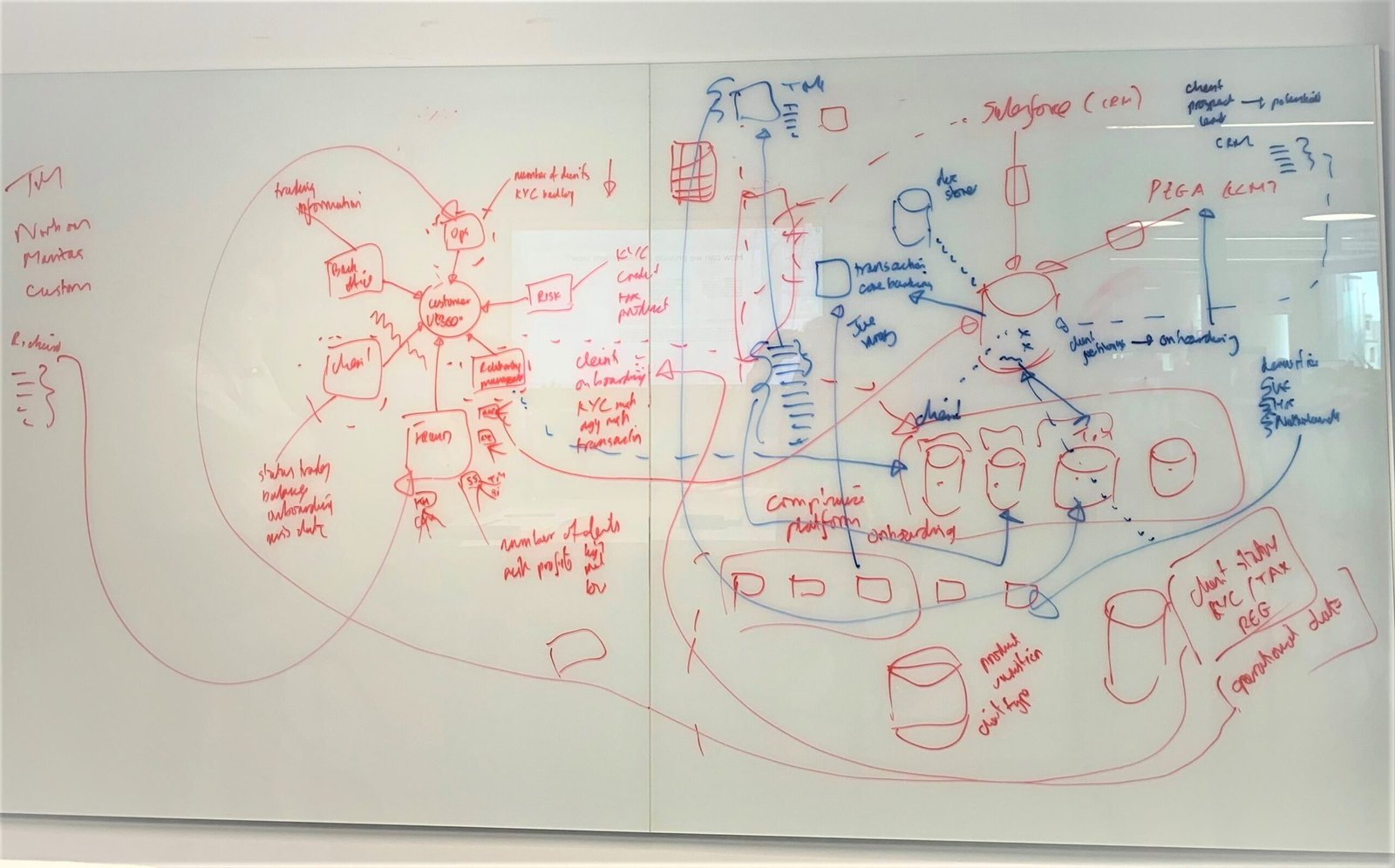

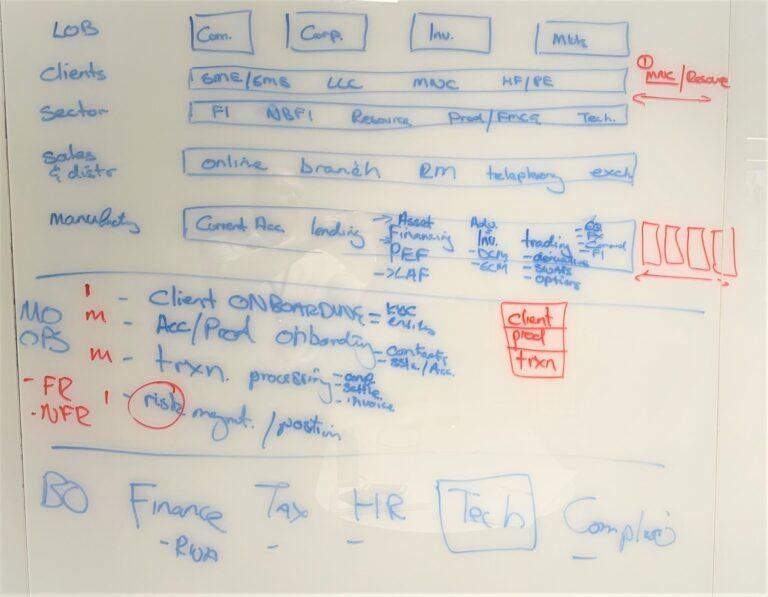

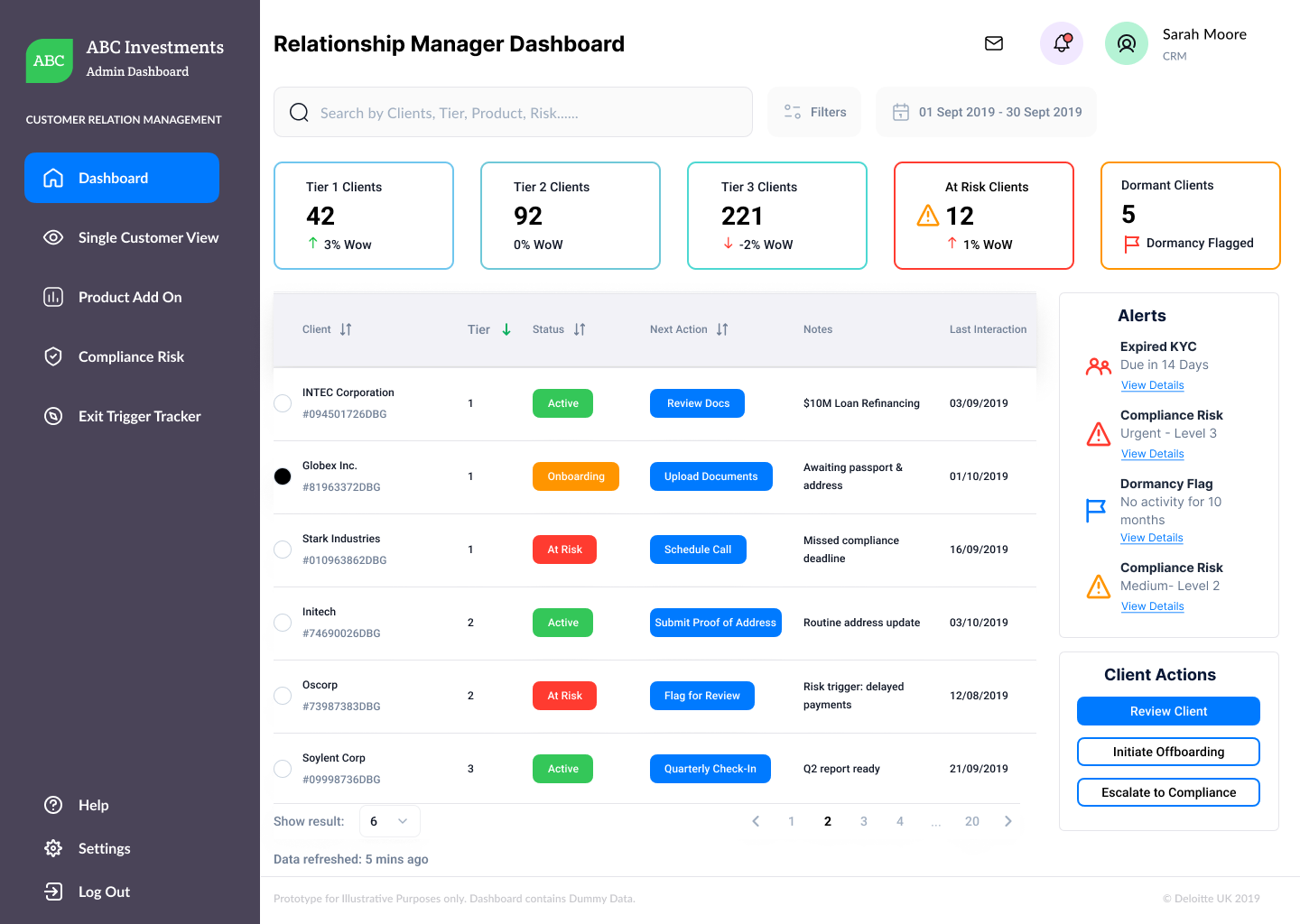

In 2019, I was brought into Deloitte’s Digital Forensics team to lead UX design on a strategic Customer Lifecycle Management (CLM) prototype for investment banking clients. The goal was to replace fragmented onboarding, compliance, and servicing processes with a unified, data-driven experience layer.

I designed five interconnected modules:

RM Dashboard – Client prioritisation by tier, SLA, and risk

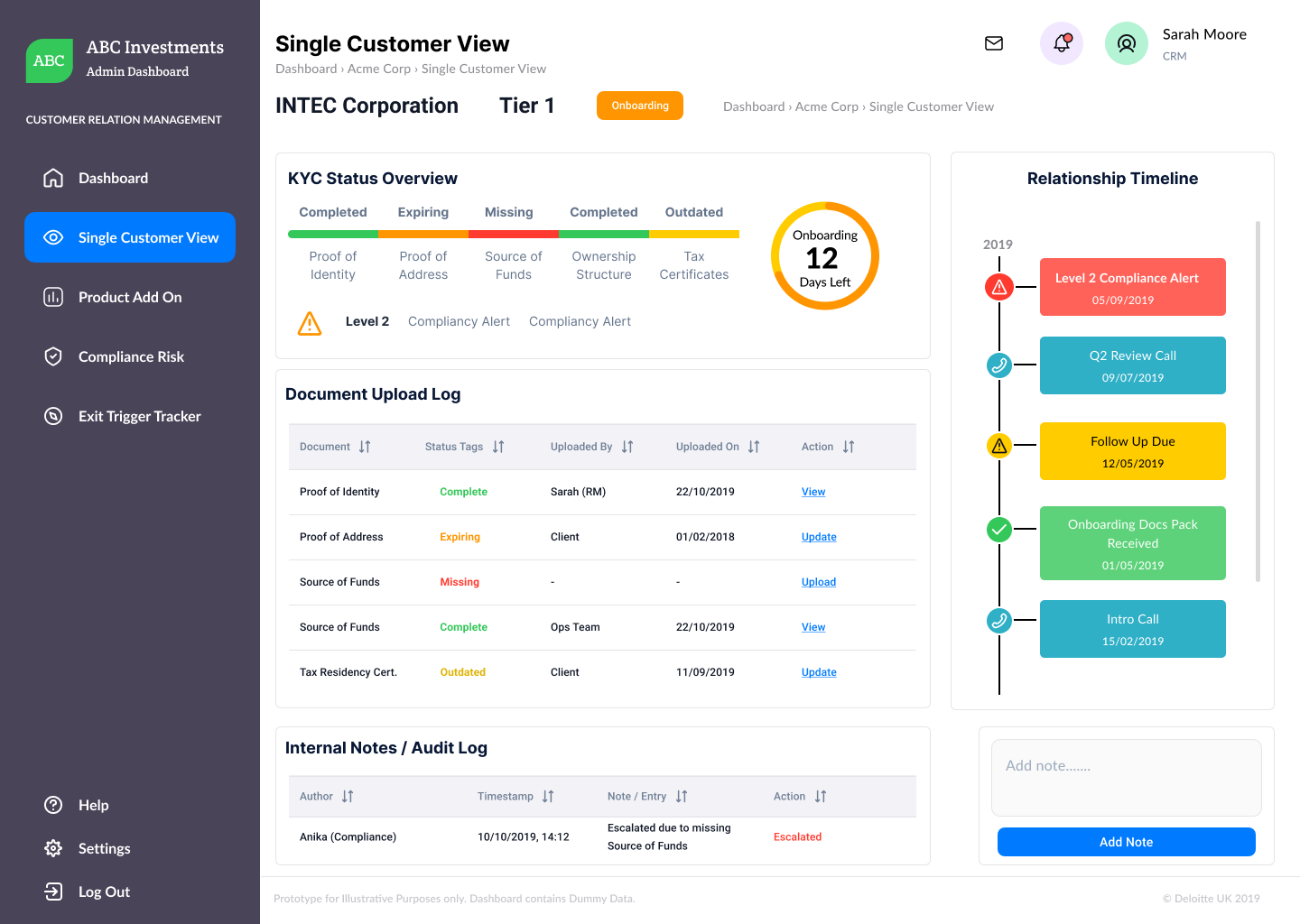

Single Customer View – Tabbed hub for KYC, risk, and document status

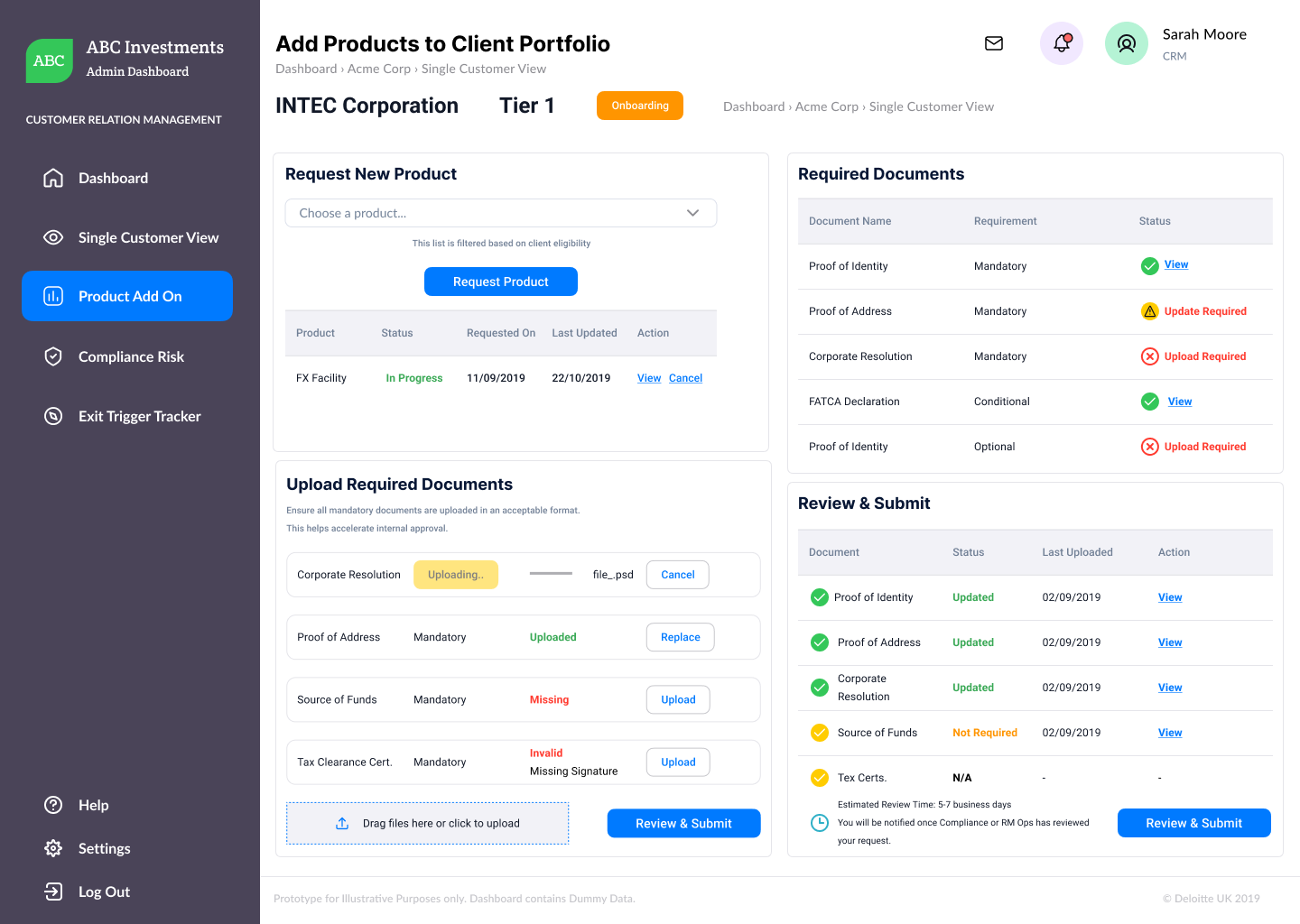

Add-On Product Flow – Guided checklist and submission logic

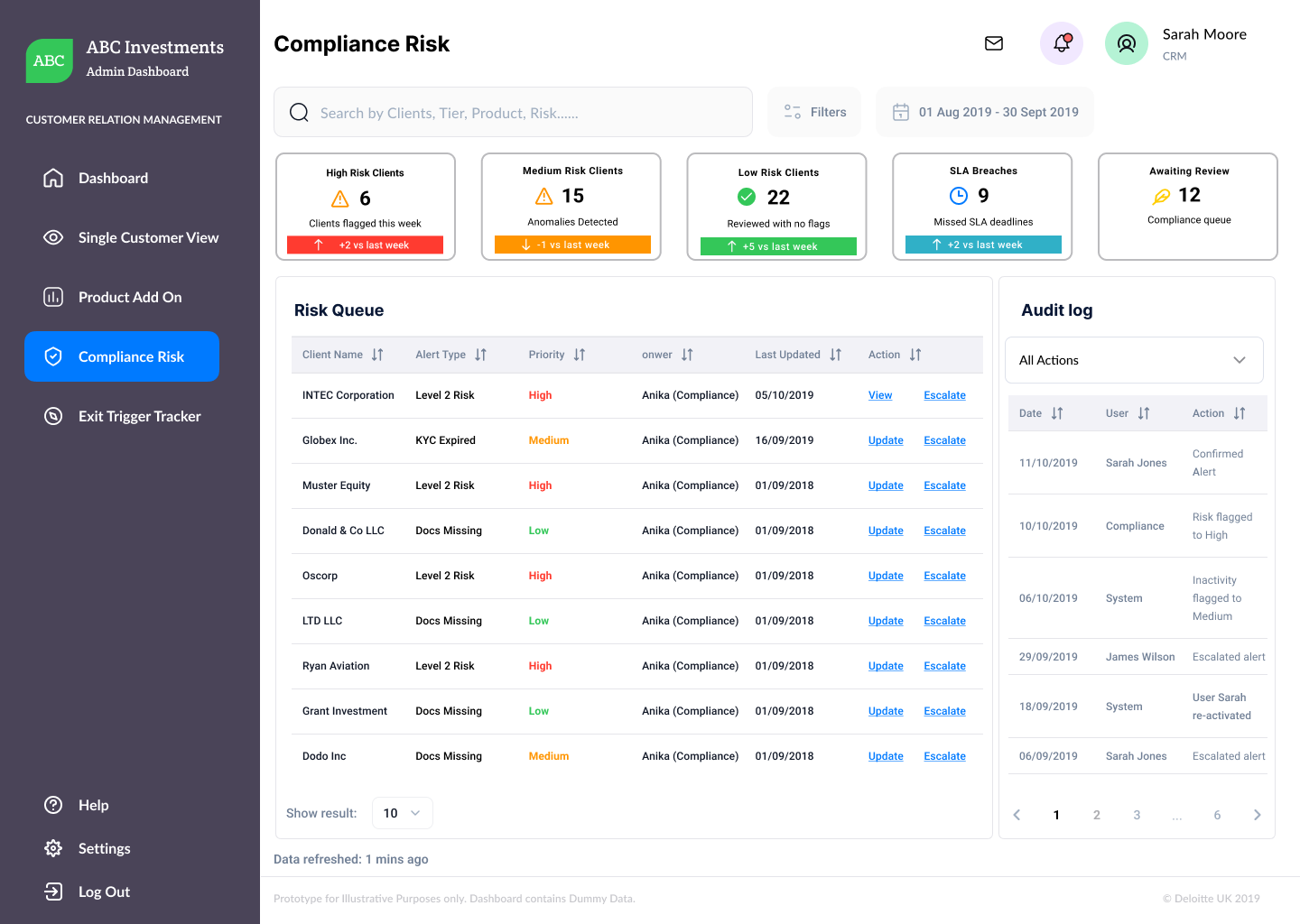

Compliance Risk Panel – Escalation dashboard and audit trail

Exit Trigger Tracker – Inactivity vs risk scatterplot to support proactive offboarding

We ran workshops, mapped user flows, prioritised MVP features, and delivered a fully validated high-fidelity prototype—grounded in accessibility, atomic design, and real-time data visualisation.

Although well received, development was paused due to:

High initial implementation costs

Risk of disrupting live banking systems

Incompatibility with some legacy infrastructure

A Beta phase was planned for early 2020 to test functionality with engineers and IT architects. I was scheduled to return to develop the design system and lead UX handover. However, the COVID-19 crisis triggered financial reprioritisation across banks and Deloitte, halting the programme before development began.

This remains a strong example of how UX can drive strategic clarity, visual governance, and data-backed decision-making in complex enterprise environments.