1. Develop a Standalone Finance Module

Build the Finance Widget micro-frontend component within Nissan’s existing framework (e.g. React).

Instrument front-end events (widget_impression, widget_click, finance_apply) for analytics.

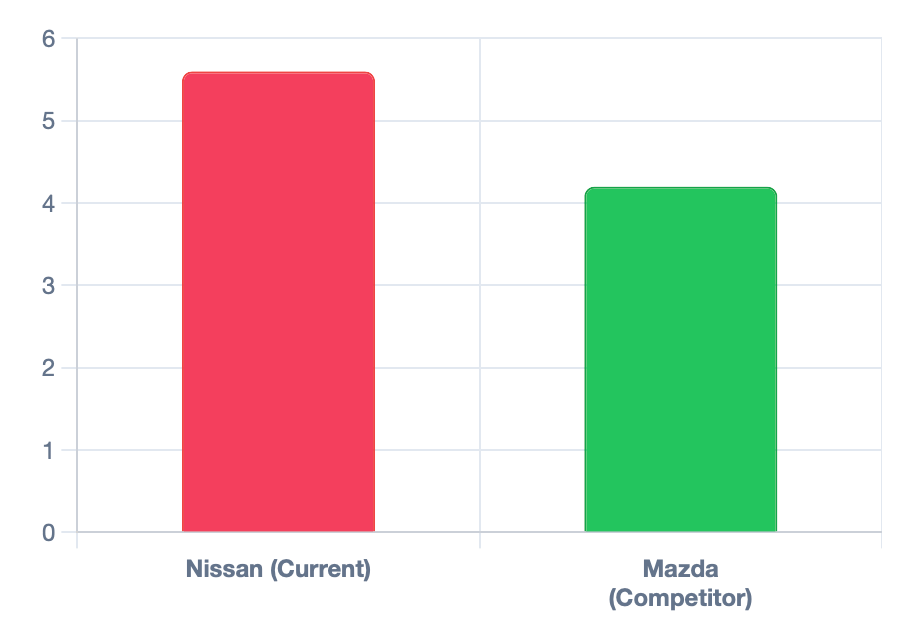

2. Dark-Launch A/B Testing

Route 50 % of configurator traffic to V2 while retaining V1 for the other 50 %.

Collect 10 000+ configuration sessions over 4–6 weeks to measure actual finance-completion lifts and ticket reductions.

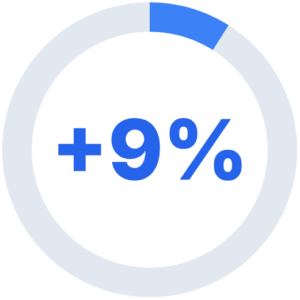

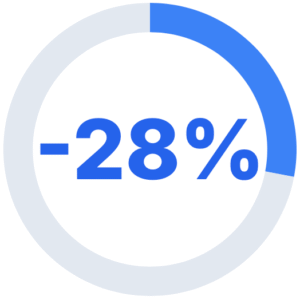

3. Iterate Based on Live Feedback

If the uplift reaches only 5 % instead of 9 %, investigate widget discoverability on small viewports, session-storage accuracy and micro-copy clarity.

Refine until metrics meet or exceed forecasts.